insurance Inspection Services in South Florida

Protect your property and stay compliant with the expert insurance inspection services offered by JLU Services. We help you safeguard your investment, meet insurance requirements, and ensure long-term peace of mind.

Excellence You Can Trust

Trusted Expertise in Insurance Inspections

Rely on JLU Services for expert insurance inspections that help you meet all regulatory and insurance requirements with confidence. Our professional evaluations are specifically tailored to address the needs of property owners seeking compliance and policy approval. With deep expertise and advanced inspection tools, we deliver thorough assessments that not only satisfy insurance carriers but also protect your investment for the long term.

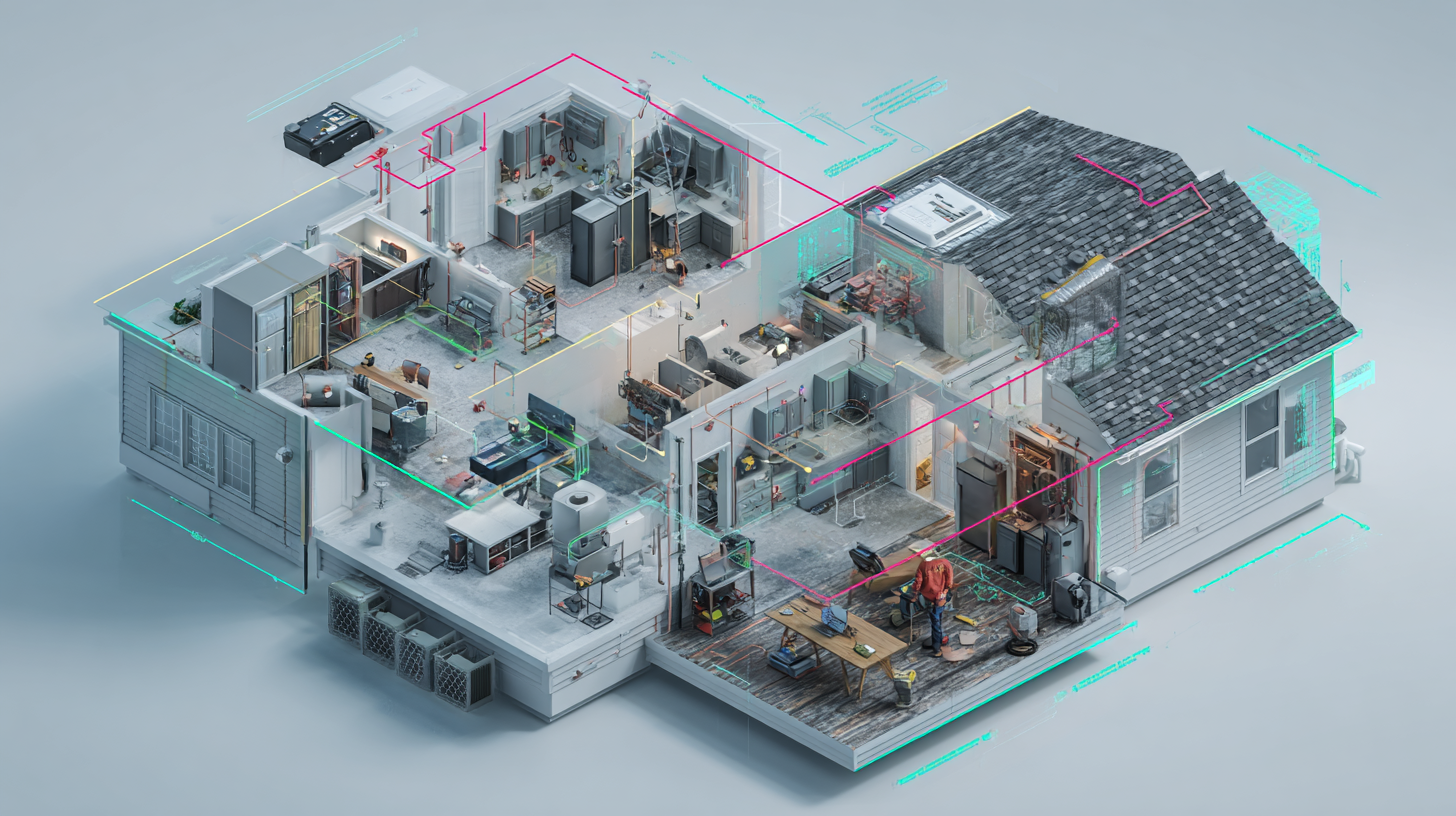

Our Insurance Inspection Services

Our specialized insurance inspection services are crafted to help property owners navigate strict insurance requirements while ensuring the safety and structural soundness of their investments. By focusing on precision and thoroughness, we evaluate every critical component of your property, leaving no stone unturned. From identifying compliance issues to safeguarding your property’s value, our inspections are conducted with advanced tools and expert methodologies, delivering unmatched accuracy and reliability tailored to your needs.

Four-Point Inspections

Insurance companies often require detailed evaluations of your roof, HVAC system, plumbing, and electrical systems. Our four-point inspections provide a comprehensive assessment, helping you meet eligibility requirements and understand the condition of these critical systems.

Wind Mitigation Inspections

Reduce your insurance premiums by demonstrating your home’s wind-resistant features. Our wind mitigation inspections identify protective elements, such as impact-resistant windows and hurricane ties, that can lessen wind damage during storms.

Roof Certificate Inspections

We specialize in roof certificate inspections to evaluate the condition, life expectancy, and integrity of your roof. These inspections are essential for insurance companies to determine your coverage eligibility.

Post-Claim Inspections

After an insurance claim, it’s crucial to ensure that repairs have been properly completed. Our post-claim inspections verify that the work meets required standards, providing documentation for both you and your insurance provider.

40-Year Recertification Inspections

Older properties require additional oversight to ensure compliance with local regulations. With our 40-year recertification inspections, we verify the structural and electrical safety of aging buildings to keep them in line with government and insurance regulations.

The Lasting Benefits of Professional Insurance Inspections

Why Choose an insurance Inspection?

Investing in a professional insurance inspection is one of the most responsible steps you can take as a property owner. Our thorough evaluations provide you with the knowledge needed to make confident, well-informed decisions—protecting your investment and ensuring you meet all insurance requirements. From uncovering issues that could result in costly repairs or insurance complications, to strengthening your property’s compliance and value, a quality insurance inspection delivers benefits far beyond the initial visit.

Prevent Unexpected Costs

Discover hidden or emerging issues before they lead to expensive repairs or uncovered damage. Proactive inspections help you avoid financial surprises and maintain the integrity of your property.

Ensure Compliance

Our inspections verify that your property meets strict insurance guidelines and local regulations, helping you avoid delays, denials, or penalties. Stay protected with documentation you can rely on.

Increase Property Value

Proper documentation and preventative care keep your investment strong. A well-maintained, fully compliant property is more attractive to insurers, buyers, and tenants alike.

Achieve Peace of Mind

Rest easy knowing your property has been expertly assessed for risks, safety, and insurance compliance. With our support, you can move forward with certainty and confidence in your coverage.

Rest easy knowing your property has been expertly assessed for risks, safety, and insurance compliance. With our support, you can move forward with certainty and confidence in your coverage.

The Commercial & Residential Replacement Cost Estimator with Xactimate

JLU Services leverages Xactimate certification to deliver trusted and precise cost estimates for commercial and residential properties.

When disaster strikes, it’s critical to understand the full scope of repair and rebuilding costs. JLU Services is certified in Xactimate, the industry-leading software relied upon by insurance companies, adjusters, and contractors to generate detailed and accurate estimates. Xactimate is used for:

- Estimating repair costs after property damage

- Calculating rebuilding expenses for both residential and commercial projects

- Generating detailed claims and assessment reports for insurance purposes

- Providing itemized cost breakdowns that align with insurance industry standards

This certification ensures that our estimates are precise, transparent, and fully aligned with the pricing data and methodologies used throughout the insurance and restoration industries.

Xactimate enables our team to provide comprehensive and transparent cost breakdowns for any property damage scenario. Whether you’re dealing with a minor repair or a full-scale rebuild, we bridge the gap between property owners, contractors, and insurance companies. The result? Faster claims processes, improved communication, and peace of mind knowing that no detail is overlooked. With every estimate we generate, JLU Services delivers clarity and confidence.

Got Questions? We’ve Got Answers

Frequently Asked Questions

We’ve compiled answers to frequently asked questions to provide clarity and help you better understand the value of our insurance inspection services.

What is an insurance inspection and why is it necessary?

An insurance inspection is a comprehensive evaluation of a property to assess its condition, identify risks, and verify that it meets insurance company requirements. These inspections are often required by insurers before issuing or renewing a policy. They help prevent potential future claims by addressing hazards early and ensuring the property is compliant with local codes and safety standards.

What types of insurance inspections are most commonly required in Florida?

In Florida, the most common insurance inspections include four-point inspections, wind mitigation inspections, roof certificate inspections, post-claim inspections, and 40-year recertification inspections. Each type focuses on specific aspects necessary for policy approval and potential premium discounts.

What does a four-point inspection include?

A four-point inspection evaluates four key systems: roofing, electrical, plumbing, and HVAC (heating, ventilation, and air conditioning). Inspectors assess the age, condition, and overall functionality of these critical components to identify issues that could affect insurability.

How does a wind mitigation inspection help lower insurance premiums?

Wind mitigation inspections identify construction features that make a property more resistant to wind damage, such as hurricane straps, impact-resistant windows, and reinforced roofs. Documenting these upgrades can qualify homeowners for significant discounts on their insurance premiums in hurricane-prone areas.

Who needs a 40-year recertification inspection?

Properties, particularly in South Florida, are required to undergo a 40-year recertification inspection to ensure their structural and electrical systems remain safe. This is a mandatory process for buildings 40 years and older and must be repeated every 10 years thereafter.

What should I expect during a roof certification inspection?

A roof certification inspection involves evaluating the age, materials, overall condition, and life expectancy of your roof. The inspector will look for signs of damage, leaks, or deterioration and confirm whether the roof meets the requirements of your insurance provider.

What happens during a post-claim inspection?

After property repairs have been completed following an insurance claim, a post-claim inspection verifies that all work was done to code and to the insurer’s specifications. This final check ensures your repairs meet quality standards and that all documentation is in order for continued coverage.

How long does an insurance inspection take?

The duration of the inspection depends on property size, type, and inspection requirements, but most are completed in 1–3 hours. Larger or older properties, or those with multiple structures, may require additional time.

What do I need to prepare before an insurance inspection?

To ensure an efficient inspection, have all key areas easily accessible—especially the attic, electrical panels, HVAC units, and water heaters. Gather any documentation related to recent repairs, renovations, or upgrades. Providing prior inspection reports can also be helpful.

Can insurance inspections save money on my premiums?

Absolutely. Inspections, especially wind mitigation and updated four-point inspections, can confirm safety features or upgrades that qualify your property for insurance discounts, potentially resulting in substantial long-term savings.

How do I schedule an insurance inspection?

Simply call (305) 409-0355 or use the contact form on our Contact Page. Flexible appointment times are available to fit your schedule, and reports are delivered promptly for your convenience.

Will I receive a report after the inspection?

Yes. After the inspection is completed, you’ll receive a detailed, easy-to-understand report highlighting findings, required improvements, and items that may impact your insurance coverage or premiums.

What if the inspection finds issues—can I still get coverage?

If significant issues are identified, most insurers require that repairs be made before issuing or renewing a policy. The inspection report will outline exactly what needs to be addressed. Once repairs are completed, a reinspection can document the updates so your coverage can proceed without unnecessary delay.

Excellence in Every Inspection

Why Choose JLU Services ?

With decades of experience and a commitment to innovation, we set the standard for property inspections in South Florida. Here’s what makes us stand out:

Unmatched Expertise

With over 20 years in the industry, our team brings unparalleled knowledge and skill to every inspection.

Licensed and Insured

We are fully licensed and insured, giving you peace of mind and confidence in our services.

Advanced Technology

Using cutting-edge tools like thermal imaging and air quality testing, we uncover what others might miss.

Customer-Centric Approach

Your satisfaction is our priority. We tailor our services to meet your unique needs and ensure a seamless experience.