What Is a 4-Point Inspection? A Complete Guide for Homeowners

When it comes to protecting your greatest investment—your home—knowledge and preparation are critical. A 4-point inspection is one of the most vital tools for homeowners, offering insight into the condition of key systems within your property. For those navigating the requirements of home insurance or maintaining an older home, understanding the ins and outs of a 4-point inspection is essential.

This comprehensive guide will break down exactly what a 4-point inspection entails, why it’s required by insurance companies, how to prepare for it, and what common issues you might encounter. We’ll also provide tips for choosing the right inspector and discuss why JLU Services is your trusted partner for inspections done right.

What Is a 4-Point Inspection?

A 4-point inspection is a focused assessment of four critical systems within a home: the roof, plumbing, electrical, and HVAC (heating, ventilation, and air conditioning). Unlike a complete home inspection, which covers a wide range of features, a 4-point inspection zeroes in on these specific systems because they have the most significant impact on the safety, functionality, and insurability of a property.

These inspections are commonly required for homes over 30 years old and are often mandated by insurance providers to assess the risk associated with insuring the home. A licensed inspector evaluates the condition and age of each system, checks for existing damage or hazards, and provides a detailed report outlining their findings.

By identifying potential problems early, homeowners can address issues before they escalate, potentially saving thousands in future repairs or insurance complications.

Why Do Insurance Companies Require a 4-Point Inspection?

Home insurance companies demand accountability and assurance when underwriting older properties. 4-point inspections help them determine whether a property poses a heightened risk due to aging infrastructure, outdated systems, or deferred maintenance.

For insurers, specific concerns typically center around fire hazards from outdated electrical wiring, water damage from leaky plumbing, or structural issues caused by an aging roof. If problems are identified during the inspection, homeowners may be asked to carry out necessary repairs before coverage is approved or renewed.

For you as a homeowner, providing a 4-point inspection report that reflects a well-maintained property can demonstrate your home’s safety and reliability, giving insurers peace of mind and helping you secure better rates or avoid coverage denials.

Pro tip: Download the official 4-Point Inspection Form from Citizens Insurance to familiarize yourself with the requirements.

How to Prepare for a 4-Point Inspection

A successful 4-point inspection begins with preparation. Here’s what you need to do to ensure your home is inspection-ready:

- Check the Roof: Inspect your roof for missing or damaged shingles, leaks, or soft spots. Make any necessary repairs to ensure it’s in sound condition.

- Inspect Plumbing Systems: Look for visible leaks under sinks, in bathrooms, and around water heaters. Ensure all pipes, fixtures, and fittings are secure and free of corrosion.

- Evaluate Electrical Systems: Replace outdated or unsafe electrical components, such as aluminum wiring or panels. Confirm that outlets and switches are functioning properly, and hire an electrician to address major repairs if needed.

- Maintain HVAC Systems: Change your air filters, ensure your HVAC unit is operational, and clean vents or ductwork to improve efficiency. Documentation of routine maintenance can also be helpful.

- Have Supporting Documentation Handy: Keep records of maintenance, repairs, and upgrades for the inspector—they may help demonstrate your home’s care and reliability.

Taking these steps will not only help you pass the inspection but can also give you a clearer picture of your home’s current state.

Common Issues Found During the Inspection

During a 4-point inspection, inspectors commonly identify issues in one or more of the four focus areas. Examples include:

- Roof: Leaks, missing shingles, pooling water, or a roof nearing the end of its usable life (typically 20–30 years).

- Plumbing: Leaky pipes, corroded components, low water pressure, or outdated systems like polybutylene or galvanized piping, which are prone to failure.

- Electrical: Outdated aluminum wiring, unsafe breaker panels, overloaded circuits, or improperly grounded outlets. These are often significant red flags for insurers.

- HVAC: Insufficient cooling performance, clogged ductwork, or units deemed unsafe for continued use can all impact the home’s insurability.

Addressing these issues proactively ensures your property remains eligible for insurance coverage and minimizes your risk of costly future repairs.

What to Look for When Hiring an Inspector

Choosing the right inspector is one of the most critical steps in the 4-point inspection process. Here’s what to consider:

- Licensing and Certification: Ensure the inspector is licensed and certified to perform inspections in your state. A reputable professional will also stay current with local building codes and regulations.

- Experience and Specialization: Look for inspectors who have extensive experience with 4-point inspections specifically, as older homes often present unique challenges.

- Reputation: Check online reviews, testimonials, and references to gauge customer satisfaction.

- Clarity and Detail: Ask whether the inspector provides detailed, easy-to-understand reports. A great report makes it easier to address any issues that arise.

- Insurance Knowledge: Select someone who understands what insurers are looking for and can provide compliant forms like those required by Citizens Insurance.

By hiring a knowledgeable professional, you’ll set yourself up for a seamless inspection experience and ensure all required documentation is accurate.

Looking for a reliable inspector in South Florida? Read on to learn why JLU Services is your best choice!

Why JLU Services Is the Right Choice

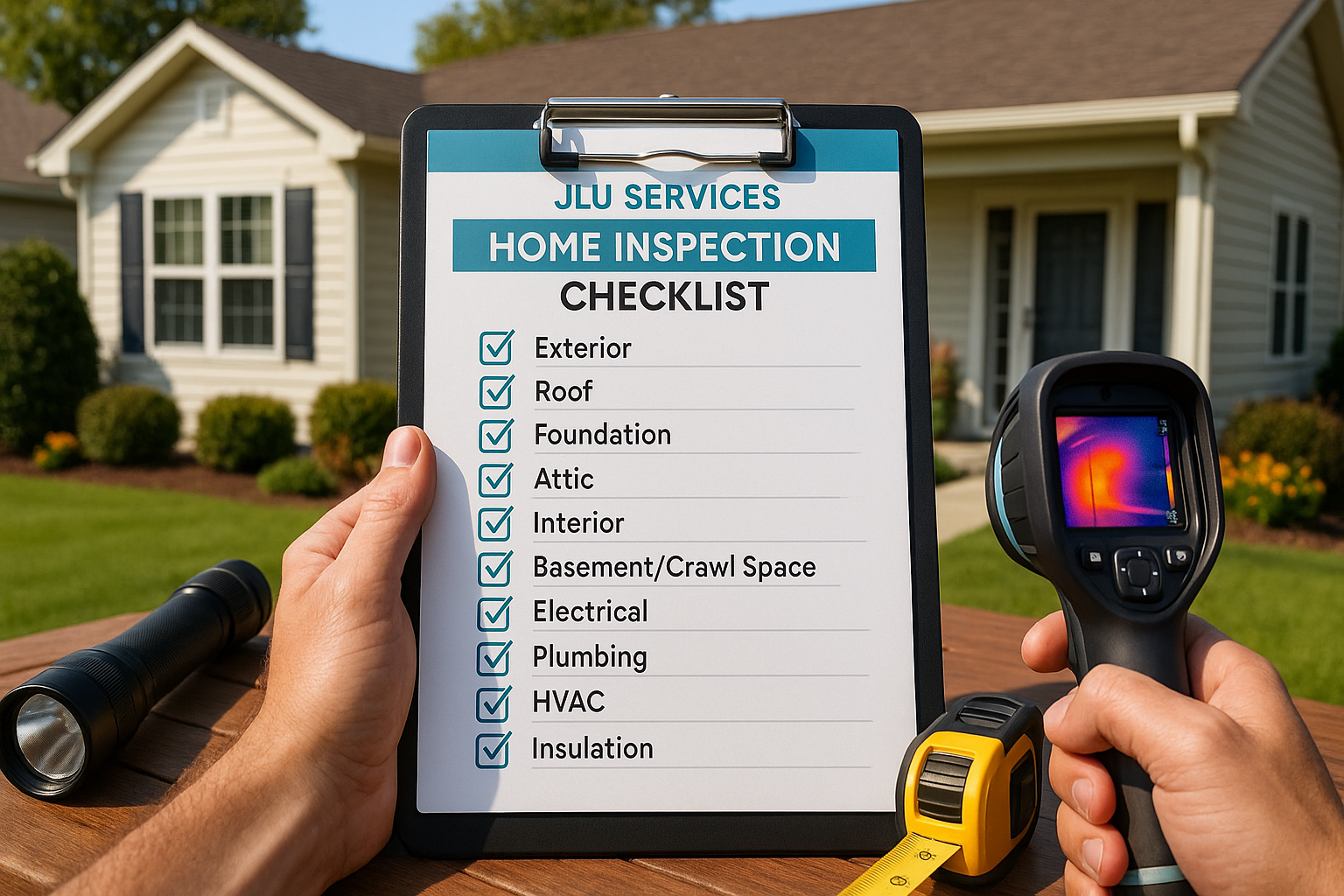

When it comes to 4-point inspections, expertise, reliability, and attention to detail matter. At JLU Services, we bring years of professional experience in home inspections to ensure you receive the most accurate and comprehensive assessments.

Here’s why homeowners and insurers trust JLU Services:

- Licensed and Certified Inspectors: Our team is fully licensed and trained to perform 4-point inspections that meet the strict requirements of insurers like Citizens Insurance.

- Cutting-Edge Technology: We use state-of-the-art tools to accurately assess your property and uncover potential issues others might miss.

- Fast, Detailed Reports: Our inspection reports are thorough, clear, and delivered promptly, giving you the information you need to move forward.

- Customer-Focused Approach: We prioritize your peace of mind by answering your questions, addressing concerns, and providing trusted guidance every step of the way.

- Local Expertise: Serving South Florida, we are familiar with the specific challenges faced by homes in the region—like hurricane damage and high humidity—that make inspections even more critical.

With JLU Services, you can be confident that both your property and your insurance considerations are in the best hands.

Schedule Your 4-Point Inspection Today!

Don’t leave your home’s safety or insurability to chance! Schedule your 4-point inspection with JLU Services today. Whether you’re preparing to meet insurance requirements or just want to know your home’s condition, we’re here to help.

📞 Call us now at (305) 409-0355 or 💻 Request your inspection online here to get started.

Need the official form? Download the 4-Point Inspection Form from Citizens Insurance and stay prepared.

Secure your peace of mind with JLU Services—where professionalism and reliability meet excellence.