Wind Mitigation Credits in Florida: What Qualifies and How Much You Can Save

If you own a property in Florida, you know that hurricane season is a serious matter. High winds can cause significant damage, leading to some of the highest homeowners insurance premiums in the country. However, there is a powerful way to lower your costs: wind mitigation credits. By proactively strengthening your home against wind damage, you can earn substantial discounts on your insurance policy.

This guide will walk you through everything you need to know about wind mitigation credits in Florida. We’ll explain what a Wind Mitigation Inspection entails, which home features qualify for discounts, and how much you could potentially save. Understanding these credits is the first step toward a safer home and a more affordable insurance bill.

What is Wind Mitigation and How Do Credits Work?

Wind mitigation refers to specific construction features that make a home more resistant to damage from high winds. In Florida, state law requires insurance companies to offer reduced rates to homeowners who have these features verified through a Wind Mitigation Inspection.

During this inspection, a licensed professional examines your property for key wind-resistant components and documents them on a standard form (OIR-B1-1802). This report is then submitted to your insurance provider, who applies the corresponding credits to your premium. The more qualifying features your home has, the greater the potential savings. These discounts can be significant, sometimes reaching up to 45% of the hurricane portion of your premium.

The 7 Key Features That Qualify for Wind Mitigation Credits

A certified inspector will evaluate seven key areas of your home. Each one that meets the state's standards contributes to your total discount.

1. Roof Covering

This refers to the material on your roof (shingles, tiles, metal) and its installation date. To qualify for a credit, the roof must have been installed to meet the 2001 Florida Building Code or newer. The inspector will need documentation, such as a permit application or receipt, to verify its age and compliance.

2. Roof Deck Attachment

This credit focuses on how your roof deck (the plywood or OSB sheathing under the shingles) is attached to the trusses. The inspector will measure the nail size and spacing. Shorter spacing and larger nails create a stronger connection, preventing the roof deck from being lifted off during a storm.

3. Roof-to-Wall Connection

This is one of the most significant credits available. It examines how your roof trusses are secured to the walls of your home. The weakest connection is toenails, while the strongest and most valuable credits are for "double wraps" or "single wraps"—metal straps that secure the truss to the top of the wall on both sides. Clips also provide a credit but are less robust than wraps.

4. Roof Geometry

The shape of your roof plays a major role in how it performs in high winds. A hip roof, which slopes down on all four sides, is more aerodynamic and qualifies for a substantial credit. A flat or gable roof does not earn this particular discount.

5. Secondary Water Resistance (SWR)

Also known as a sealed roof deck, this is a layer of protection applied directly to the roof sheathing. This self-adhering modified bitumen underlayment prevents water from entering your home even if the primary roof covering is blown off. It’s a valuable feature for preventing catastrophic water damage.

6. Opening Protection

This credit is awarded for protecting all glazed openings (windows, glass doors, skylights) from wind-borne debris. To qualify, every opening must be protected with rated impact-resistant glass or hurricane shutters. If even one window or door is unprotected, you will not receive this credit.

7. Gable End Bracing

If your home has a gable roof, the triangular wall section at the end must be braced to meet current building code standards. This reinforcement prevents the gable end from collapsing under intense wind pressure.

Preparing for Your Wind Mitigation Inspection

To ensure a smooth and accurate inspection, it’s helpful to gather any relevant documents beforehand. This may include:

- Permits for roof replacement or window/door installations.

- Product specifications or receipts for hurricane shutters.

- Any building plans or previous inspection reports.

The inspector will need access to your attic to check the roof-to-wall connections and roof deck attachment, so make sure the area is accessible. The entire process is non-invasive and typically takes less than an hour to complete.

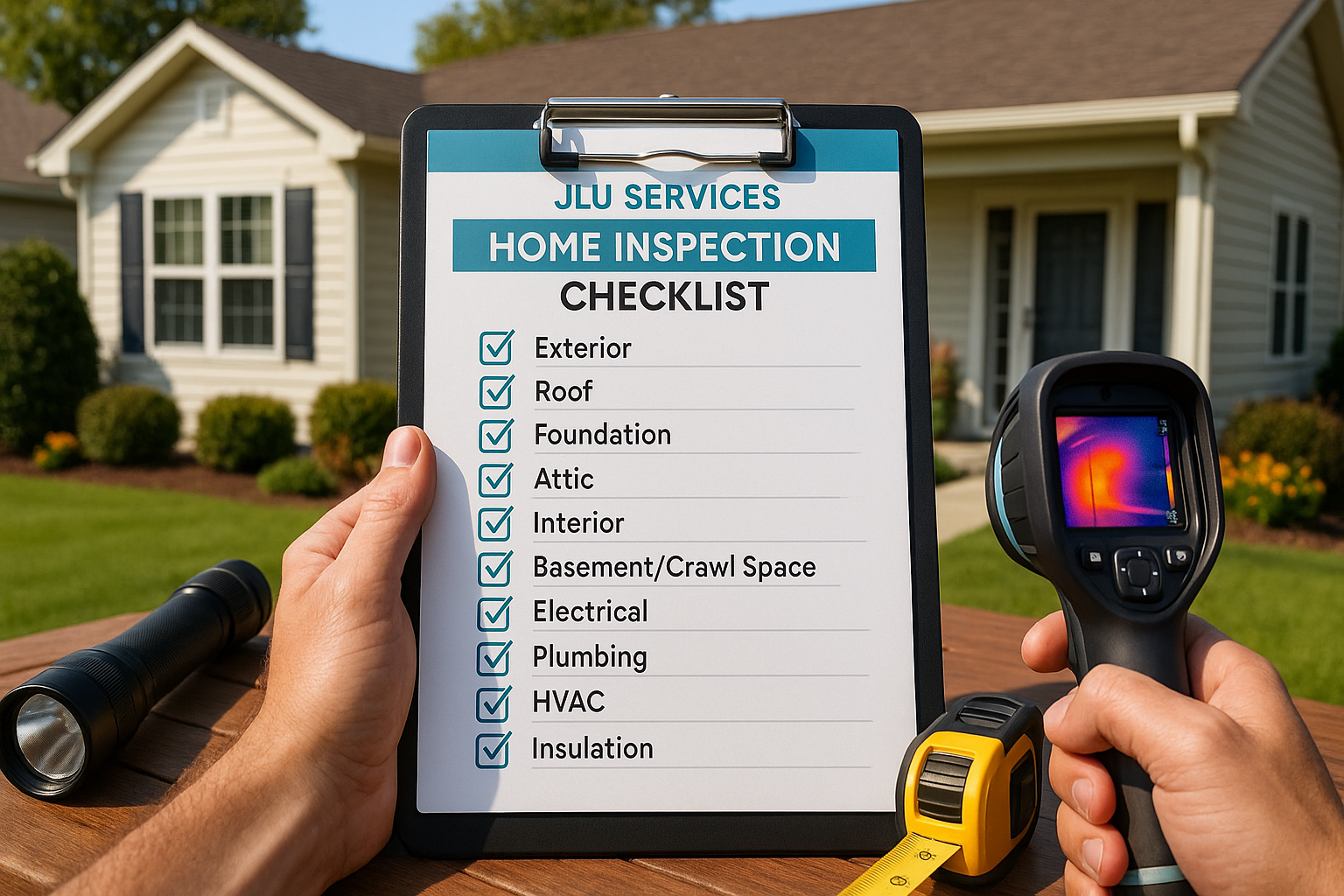

Why Choose JLU Services for Your Inspection?

Navigating Florida’s insurance landscape requires an inspector with deep local knowledge and a commitment to accuracy. At JLU Services, we provide the expertise you need to maximize your savings and protect your property.

- Decades of South Florida Experience: With over 20 years serving the region, we understand the specific challenges posed by hurricanes and the nuances of local insurance requirements.

- Licensed, Insured, and Certified: Our inspectors are fully licensed and insured, providing professional and reliable services you can trust for all your Insurance Inspections.

- Insurer-Accepted Reports: We have a proven track record of producing clear, accurate reports that are accepted by every major insurance carrier in Florida, ensuring you get the credits you deserve.

- Advanced Technology: We use high-resolution cameras to provide clear photographic evidence for every qualifying feature, leaving no room for ambiguity.

- Fast and Efficient Service: We know your time and money are valuable. Our team delivers your official Wind Mitigation Inspection report quickly, often within 24 hours, so you can submit it to your insurer without delay.

From Comprehensive Home Inspections for new buyers to specialized Roof Inspections and Post-Claim Inspections, JLU Services is your trusted partner for property safety and peace of mind.

Ready to unlock your savings? Contact JLU Services today to schedule your Wind Mitigation Inspection and discover how much you can save on your homeowner's insurance.